Business Loans: What You Should Know

From the start-up phase forward, many business owners require a business loan of one kind or another at some point in time. However, not all loans are created equal and certain terms can cause confusion. Take a look at this guide to business loan terms before moving forward.

How Much to Borrow

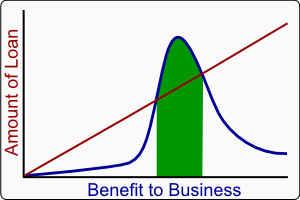

Borrowing too little can lead to a failed business initiative while borrowing too much can set a business back for an indefinite amount of time in the future. To determine how much to borrow, create a business plan that encompasses your goals and objectives. Which endeavors are necessary for taking your business from where you are now, to where you can go in the future? Are there other options – investment partners, grants and so on? Answer these questions to be sure your business loan serves as a beneficial supplement, rather than an insurmountable obstacle for moving forward.

Lenders

The days of walking into a single bank or credit union and accepting the loan offer presented in the first meeting are gone. In fact, business owners have more options than ever before relating to funding. They include:

- Banks

- Credit Unions

- Local Government Loan Programs

- Small Business Administration Debt Financing

- Small Business Administration Surety Bonds, and more.

A lender should understand your objectives and work with you to secure necessary funding. Doing research and examining multiple options is critical for success in obtaining the loan that’s the best fit for your business needs.

Promissory Notes

Promissory notes outline loan details and make both parties aware of responsibilities. The promissory note effectively states that you – the borrower – will pay back the loan amount at a specific interest rate. This makes the loan official and clarifies any questions that could arise in the future.

While borrowing from friends and family members, it’s especially important to secure a promissory note to avoid unnecessary misunderstandings going forward. Documentation is critical.

Interest Rates

Laws are in place to prevent lenders from charging inflated interest on loans. In general, a lender can charge up to 10% per year without crossing this threshold. If you’re unsure of whether your interest rate falls under state law, checking with a business law attorney could protect you and your business.

Like high interest rates, rates that are low could attract the attention of the IRS. When an interest rate is too low, it can be considered a capital investment with repayments classified as dividend payments. This should be avoided.

Security or Collateral

Many lenders require borrowers to put up valuable property as security or collateral. This property can be collected and sold if loan payments are not made. It’s important to be aware of this practice when looking for a business loan and to discuss options with a business law attorney. There are ways to protect personal property when creating a business, such as setting up a Limited Liability Corporation.

Do you have questions relating to business loans or any other aspect of managing your business according to law? Contact Attorney Michael Hynum of Hynum Law today. We look forward to working with you.